MV Shield

Powered by

Next Generation AML solution for mutuals

A single platform built for UK mutuals to streamline AML operations and financial crime management.

Financial-crime risk is rising, resources are not

Lenders face growing AML pressure with limited teams, legacy systems, fragmented tools, rising audit expectations and more regulatory scrutiny than ever.

The challenges:

Manual, disconnected

AML tools

High false-positive

volumes

Small compliance

teams

Legacy systems

and manual processing

Increasing FCA

expectations

Time consuming

investigation

MV + Napier AI

AML expertise + mutual-sector insight.

A powerful partnership.

Mutual Vision

brings:

Napier AI

brings:

Introducing

MV Shield

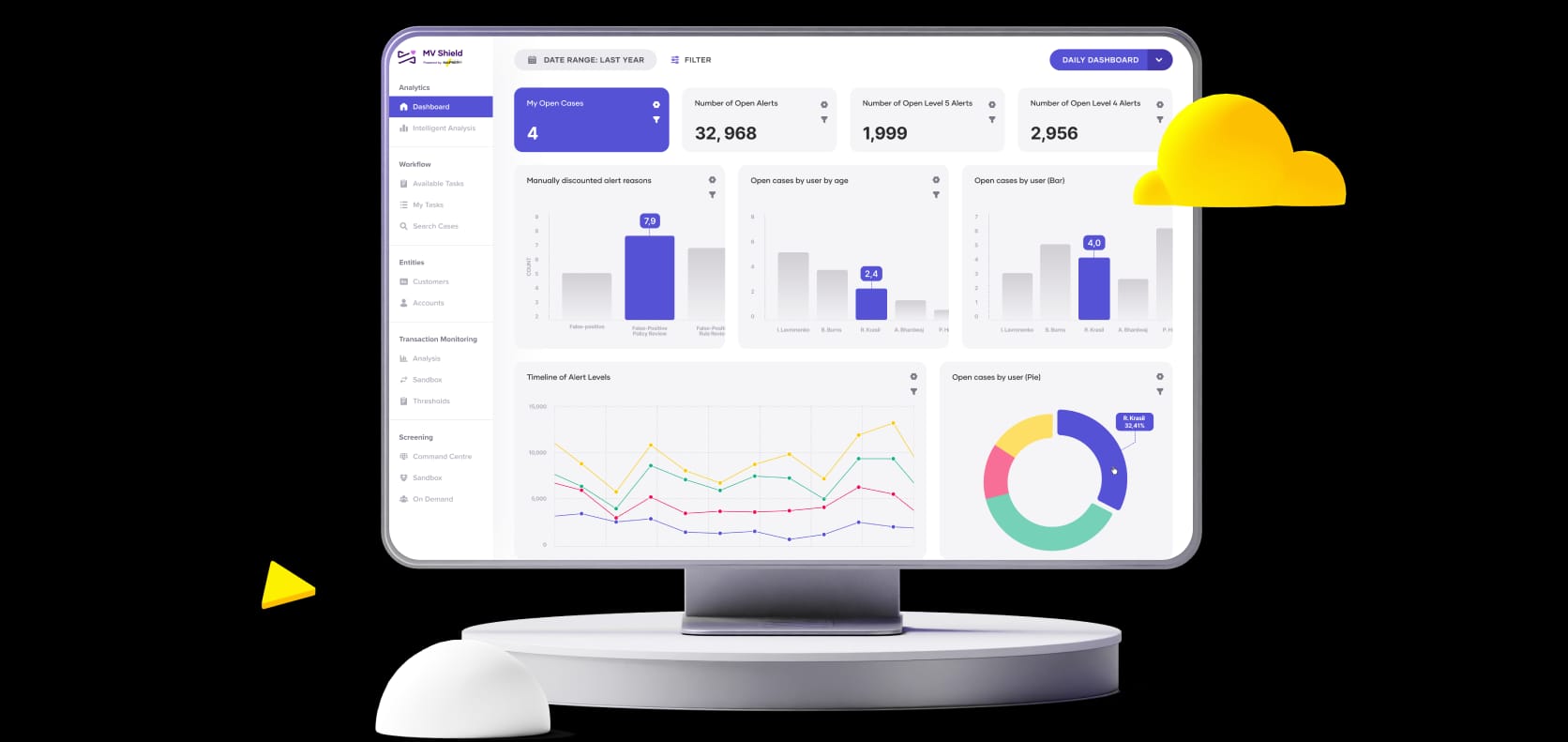

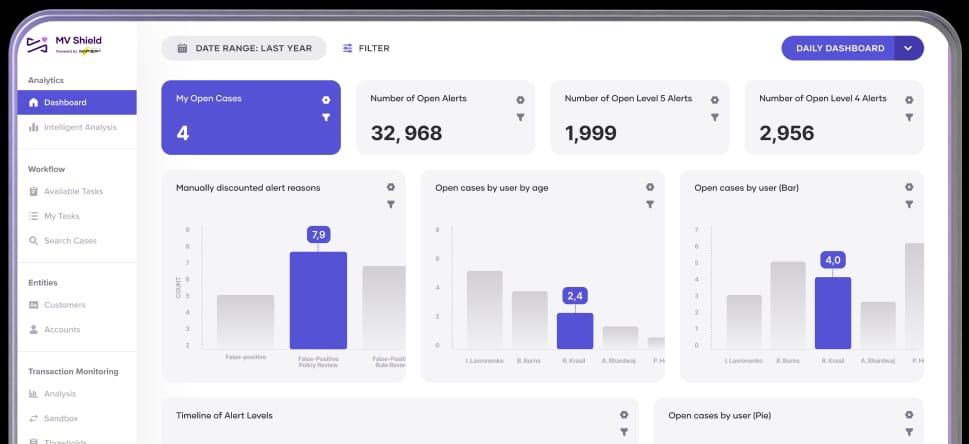

A single platform for Transaction monitoring, Client screening, Workflows and Intelligence.

MV Shield brings together all core AML capabilities in one modern, intuitive solution preconfigured for mortgage and savings behaviours, and supported end-to-end by Mutual Vision.

Customer & Entity Screening

95%+ accuracy using Rosette

Transaction Monitoring

Preconfigured scenarios; explainable logic

Case Management

Unified alerts, audit trail, and faster investigations

AI-Driven Risk Intelligence

Utilises AI to prioritise risk, surface hidden patterns, explain decisions clearly, and enable faster investigation

How MV Shield works

Simple to integrate

MV Shield connects directly with your existing platforms no duplication, no retyping. Data flows securely across your ecosystem while maintaining full auditability.

Why Mutuals choose

MV Shield

MV Shield is modern AML intelligence, purpose-built for lenders where compliance teams are smaller and workloads are high. It combines Napier AI’s advanced detection technology with Mutual Vision’s 25+ years of sector insight to deliver a solution that fits the way mutuals actually operate.

Key features

A single platform for modern financial crime prevention

MV Shield brings together financial crime controls into one intuitive, unified environment. Rather than operating separate tools for different AML activities, teams can manage alerts, intelligence and investigations within a single platform designed to reduce fragmentation and operational friction.

The platform is preconfigured for specialist lenders and mutual organisations, enabling faster deployment and immediate relevance without extensive custom build or complex configuration projects.

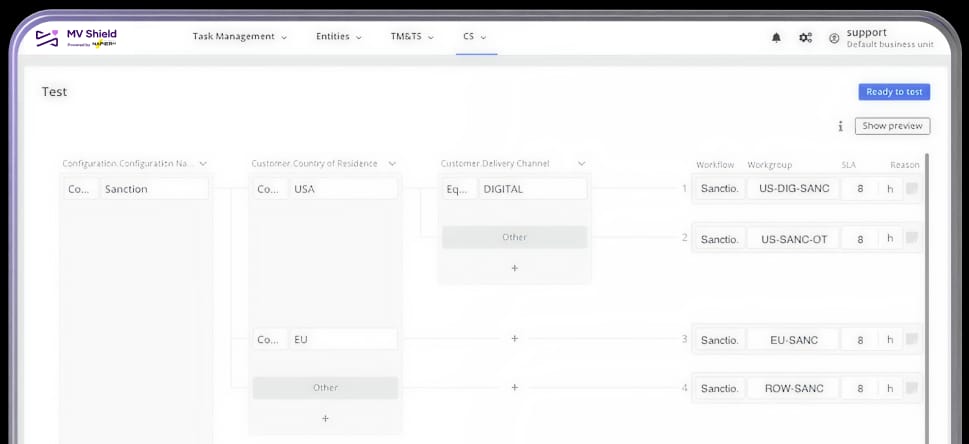

Sanctions and risk screening aligned to regulatory expectations

MV Shield screens customers against relevant sanctions lists and risk indicators to identify potential exposure early. Screening is designed to support regulatory obligations while remaining practical for smaller compliance teams, helping reduce noise and unnecessary manual review.

Screening outputs are integrated into the wider platform, allowing teams to assess screening results alongside transaction behaviour and customer risk context.

Dynamic customer risk scoring

MV Shield assigns client risk scores based on observed customer behaviour and available intelligence. Risk assessment supports ongoing monitoring rather than one-off categorisation, enabling teams to respond to changes in customer risk profiles over time.

This approach helps compliance teams focus attention where risk is genuinely evolving, rather than relying on static risk labels.

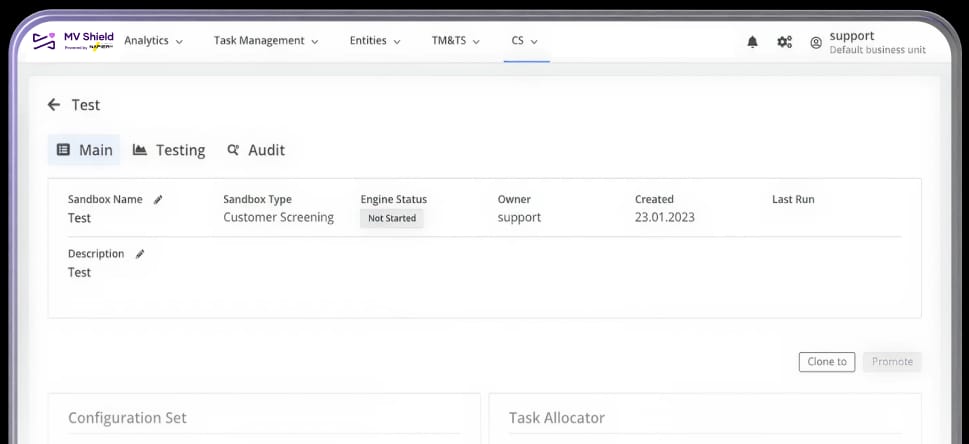

Refine screening and monitoring before go-live

The Advanced Sandbox allows compliance teams to refine screening setups and monitoring logic using real data before launch. This enables safer configuration, validation and optimisation without impacting live operations.

The sandbox supports confident decision-making during implementation and change management, particularly important for regulated environments.

Accessible intelligence across the organisation

The Data Explorer makes financial crime intelligence data accessible for compliance and risk teams. Rather than locking insight behind technical interfaces, teams can explore trends, patterns and supporting data directly within the platform.

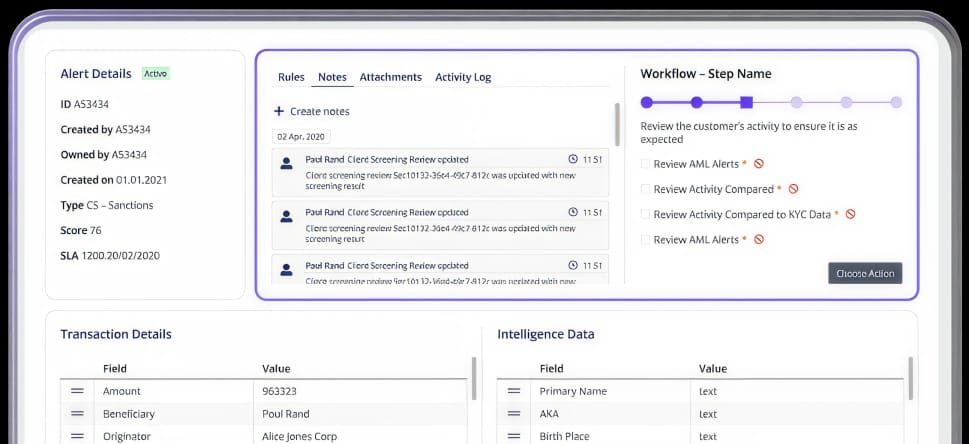

Unified investigation workflow with self-auditing

MV Shield will introduce task management and workflow functionality to unify investigation steps within a single, self-auditing platform. This will support structured case handling, accountability and clearer audit trails.

The workflow capability is designed to align with regulatory expectations while remaining practical for smaller teams.

Behaviour-led monitoring powered by AI

MV Shield detects suspicious transaction patterns using AI-driven analytics designed to identify abnormal or emerging behaviour. Rather than relying solely on static thresholds, transaction monitoring supports more adaptive detection aligned to modern financial crime typologies.

Alerts are contextualised with supporting data to help teams prioritise genuinely higher-risk activity.

Streamlined identity checks and risk scoring

MV Shield will support automated onboarding KYC and KYB processes, combining identity verification with integrated risk scoring. The capability is designed to reduce manual effort during onboarding while maintaining alignment with regulatory expectations.

By embedding onboarding within the wider AML platform, MV Shield supports continuity between initial checks and ongoing monitoring.

Faster, clearer alert investigation

MV Shield provides an efficient hit review interface that highlights the most relevant and urgent data for investigation on a single page. This reduces time spent navigating multiple screens and improves consistency across reviews.

The design supports quicker triage and more confident decisions, helping teams manage alert volumes effectively.

Utilises AI to prioritise risk and surface hidden patterns

MV Shield’s combines explainable decision support with performance and behavioural intelligence to help compliance teams understand why alerts are triggered, prioritise genuine risk, and continuously improve outcomes over time.

Rather than black-box outputs, the platform provides clear insight into decision drivers, alert behaviour and emerging risk patterns, supporting transparency, audit readiness and internal confidence. Also analyses alert trends and operational data to identify inefficiencies and excessive false positives, enabling ongoing optimisation without the need for complex external analytics tools.

Configured for mutual-sector reality

MV Shield is configured specifically for specialist lenders and organisations without large compliance resources. The platform prioritises usability, clarity and operational efficiency while supporting regulatory compliance.

Powered by Napier AI technology and guided by Mutual Vision’s mutual-sector experience, MV Shield balances advanced capability with practical delivery.

Ready to see

MV Shield live?

Let us show you how MV Shield fits your team. From demo to deployment, we’re here to guide you.

Book a demo. Ask anything. No pressure.

Got it!

Your message is on its way. Our team will review it and be in touch shortly.